- Loading...

IRS Release Status: FINAL

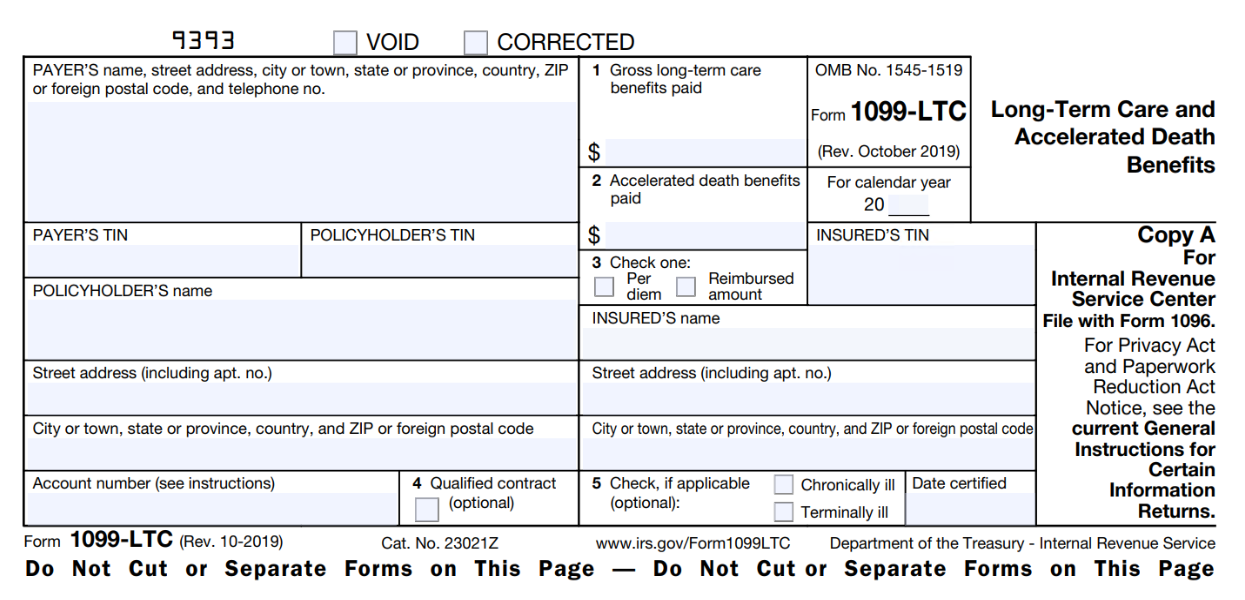

Sample Excel Import File: 1099-LTC 2023.xlsx

| Field Name | Size | Type | Description | Notes |

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| Box 1 Amount | 12 | Amount | Box 1: Gross long-term care benefits paid | |

| Box 2 Amount | 12 | Amount | Box 2: Accelerated death benefits paid | |

| Box 3 Checkbox 1 | 1 | Checkbox | Box 3: Per diem | X / Y / T / 1 = Checked |

| Box 3 Checkbox 2 | 1 | Checkbox | Box 3: Reimbursed amount | X / Y / T / 1 = Checked |

| Box INS SSN | 9 | Numeric | INSURED'S social security no. | |

| Box INS Name | 40 | Text | INSURED'S name | |

| Box INS Address | 40 | Text | Street address (including apt. no) | |

| Box INS City | 18 | Text | City of Insured | |

| Box INS State | 2 | Text | State of Insured | Use state abbreviation |

| Box INS Zip | 9 | Numeric | ZIP/Postal of Insured | |

| Box 4 Checkbox | 1 | Checkbox | Box 4: Qualified contract (optional) | |

| Box 5 Checkbox 1 | 1 | Checkbox | Box 5: Chronically ill (optional) | X / Y / T / 1 = Checked |

| Box 5 Checkbox 2 | 1 | Checkbox | Box 5: Terminally ill (optional) | X / Y / T / 1 = Checked |

| Box 5 Date | 8 | Date | Box 5: Date Certified | MM/DD/YYYY or M/D/YYYY |

| See Form Common Fields | Form fields common to all form types. | |||

1099-LTC Form:

IRS 1099-LTC Form: https://www.irs.gov/pub/irs-pdf/f1099ltc.pdf

IRS 1099-LTC Instructions: https://www.irs.gov/pub/irs-pdf/i1099ltc.pdf

Overview

Content Tools