- Loading...

IRS Release Status: FINAL

Sample Excel Import File: 1099-MISC 2023.xlsx

Sample Multi-PCode Excel Import File (Corporate Suite Only): CS_1099-MISC 2023 Multi Pcode w Filter RecType.xlsx

Import Form Fields:

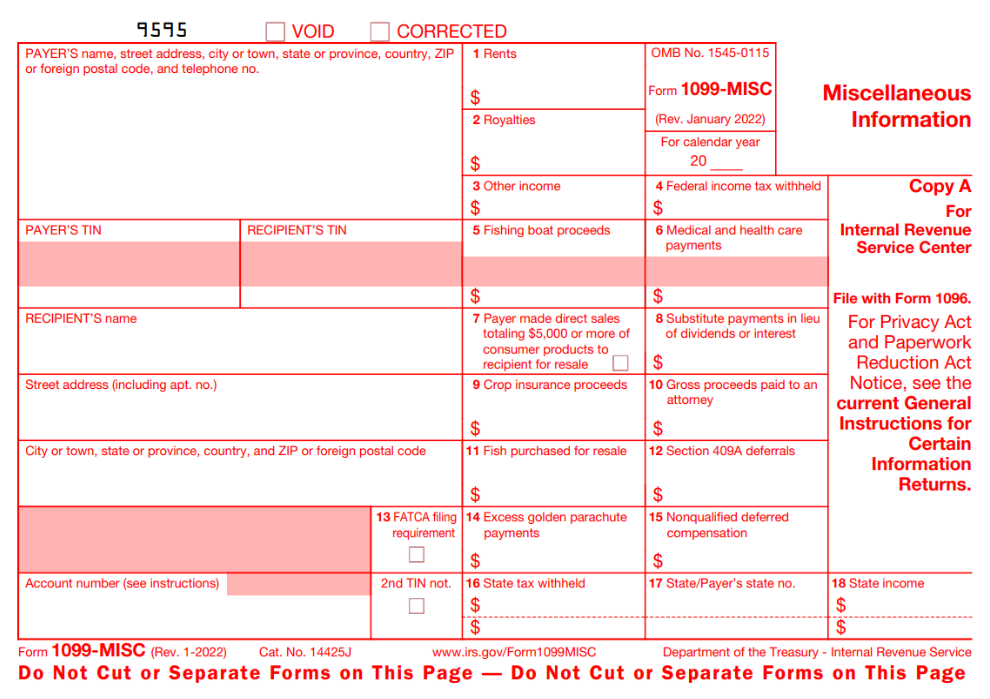

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

FATCA Checkbox | 1 | Checkbox | FATCA filing requirement | X / Y / T / 1 = Checked |

| 2nd TIN notice | 1 | Checkbox | 2nd TIN notice | X / Y / T / 1 = Checked |

Box 1 Amount | 12 | Amount | Box 1: Rents | |

Box 2 Amount | 12 | Amount | Box 2: Royalties | |

| Box 3 Amount | 12 | Amount | Box 3: Other Income | |

Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Amount | 12 | Amount | Box 5: Fishing boat proceeds | |

| Box 6 Amount | 12 | Amount | Box 6: Medical & health care payments | |

| Box 7 Checkbox | 1 | Checkbox | Box 7: Payer made direct sales of $5000 or more of..... | X / Y / T / 1 = Checked |

| Box 8 Amount | 12 | Amount | Box 8: Substitute payments in lieu of dividends or interest | |

| Box 9 Amount | 12 | Amount | Box 9: Crop insurance proceeds | |

| Box 10 Amount | 12 | Amount | Box 10: Gross proceeds paid to an attorney | |

| Box 11 Amount | 12 | Amount | Box 11: Fish purchased for resale | |

Box 13 FATCA Checkbox | 1 | Checkbox | Box 13: FATCA filing requirement | X / Y / T / 1 = Checked |

| Box 14 Amount | 12 | Amount | Box 13: Excess golden parachute payments | |

| Box 15 Amount | 12 | Amount | Box 15: Nonqualified deferred compensation | |

| Box 16 Amount | 12 | Amount | Box 16: State tax withheld | |

| Box 17 State | 2 | Text | Box 17: State abbreviation code | Use state abbreviation |

| Box 17 ID Number | 20 | Text | Box 17: State ID number | Given by State Department of Revenue |

| Box 18 Amount | 12 | Amount | Box 18: State Income | |

| See Form Common Fields | Form fields common to all form types. | |||

1099-MISC Form:

IRS 1099-MISC Form: https://www.irs.gov/pub/irs-pdf/f1099msc.pdf

IRS 1099-MISC Instructions: https://www.irs.gov/pub/irs-pdf/i1099mec.pdf

Overview

Content Tools