- Loading...

IRS Release Status: FINAL

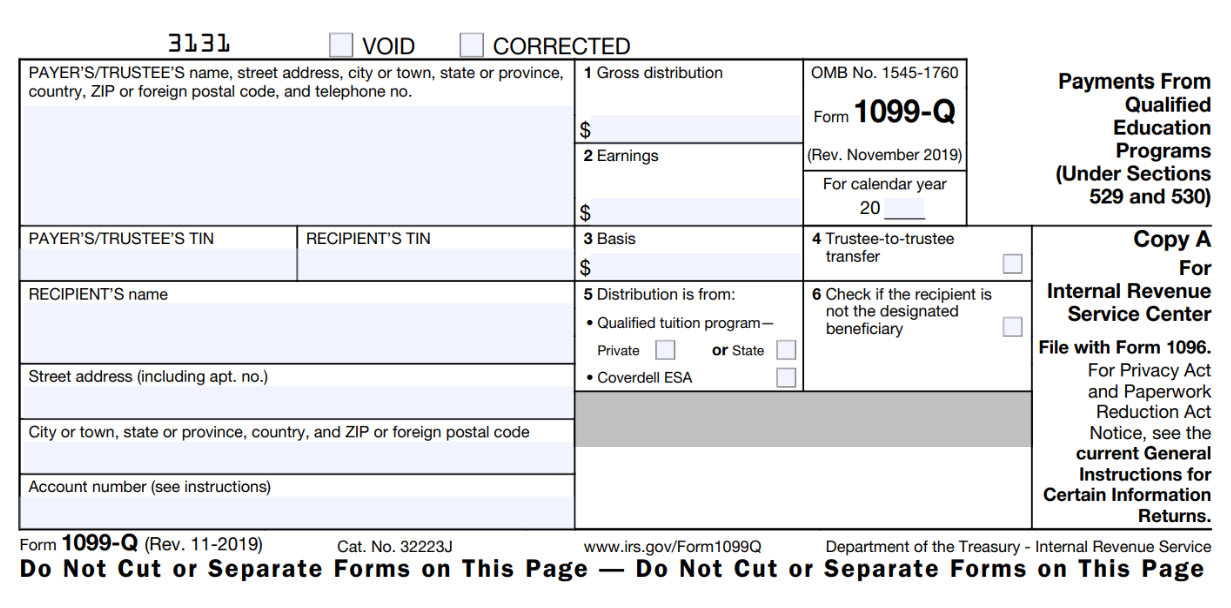

Sample Excel Import File: 1099-Q 2023.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| Box 1 Amount | 12 | Amount | Box 1: Gross distribution | |

| Box 2 Amount | 12 | Amount | Box 2: Earnings | |

| Box 3 Amount | 12 | Amount | Box 3: Basis | |

| Box 4 Checkbox | 1 | Checkbox | Box 4: Trustee-to-trustee transfer | X / Y / T / 1 = Checked |

| Box 5 Checkbox 1 | 1 | Checkbox | Box 5 Distribution is from: Private | X / Y / T / 1 = Checked |

| Box 5 Checkbox 2 | 1 | Checkbox | Box 5 Distribution is from: State | X / Y / T / 1 = Checked |

| Box 5 Checkbox 3 | 1 | Checkbox | Box 5 Distribution is from: Coverdell ESA | X / Y / T / 1 = Checked |

| Box 6 Checkbox | 1 | Checkbox | Box 6: Check if the recipient is not the designated beneficiary | X / Y / T / 1 = Checked |

| Box X Amount | 12 | Amount | FMV amount | |

| Box X Code | 1 | Numeric | Distribution Code (1-6) | See IRS Instructions |

| See Form Common Fields | Form fields common to all form types. | |||

1099-Q Form:

IRS 1099-Q Form: https://www.irs.gov/pub/irs-pdf/f1099q.pdf

IRS 1099-Q Instructions: https://www.irs.gov/pub/irs-pdf/i1099q.pdf

Overview

Content Tools