- Loading...

IRS Release Status: FINAL

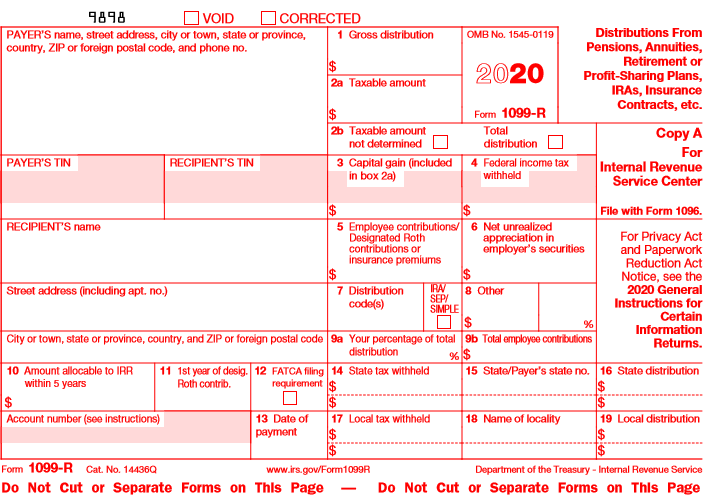

Sample Excel Import File: (Professional/Enterprise) 1099-R 2020.xlsx

Sample Excel Import File: (Corporate Suite) 1099-R 2020 Map by Name.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Box 1 Amount | 12 | Amount | Box 1: Gross distribution | |

Box 2a Amount | 12 | Amount | Box 2a: Taxable amount | |

| Box 2b Checkbox 1 | 1 | Checkbox | Box 2b: Taxable amount not determined | X / Y / T / 1 = Checked |

| Box 2b Checkbox 2 | 1 | Checkbox | Box 2b: Total distribution | X / Y / T / 1 = Checked |

| Box 3 Amount | 12 | Amount | Box 3: Capital gain (included in box 2a) | |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Amount | 12 | Amount | Box 5: Employee contributions/Designated Roth contribution or insurance premiums | |

| Box 6 Amount | 12 | Amount | Box 6: Net unrealized appreciation in employer's securities | |

| Box 7 Code(s) | 2 | Text | Box 7: Distribution Code(s) | See IRS instructions |

| Box 7 Checkbox | 1 | Checkbox | Box 7: IRA / SEP / SIMPLE | X / Y / T / 1 = Checked |

| Box 8 Amount | 12 | Amount | Box 8: Other | |

| Box 8 Number | 2 | Numeric | Box 8: Other percentage | 0 - 99 |

Box 9a Number | 2 | Numeric | Box 9a: Your percentage of total distribution | 0 - 99 |

| Box 9b Amount | 12 | Amount | Box 9b: Total employee contributions | |

| Box 10 Amount | 12 | Amount | Box 10: Amount allocable to IRR within 5 years | |

| Box 11 Roth Year | 4 | Numeric | Box 11: 1st year of Roth contribution | YYYY |

| Box 12 FATCA Checkbox | 1 | Checkbox | Box 12: FATCA filing requirement | X / Y / T / 1 = Checked |

| Box 13 Date of payment | 10 | Text | Box 13: Date of Payment | MM/DD/YYYY or M/D/YYYY |

| Box 14 Amount | 12 | Amount | Box 14: State tax withheld | |

| Box 15 ID Number | 20 | Text | Box 15: State/Payer's state number | Given by State Department of Revenue |

| Box 15 State | 2 | Text | Box 15: State abbreviation code | Use state abbreviation |

| Box 16 Amount | 12 | Amount | Box 16: State distribution | |

| Box 17 Amount | 12 | Amount | Box 17: Local tax withheld | |

| Box 18 Name | 15 | Text | Box 18: Name of locality | |

| Box 19 Amount | 12 | Amount | Box 19: Local distribution | |

| Alt Account/PACE | 40 | Text | Alternate Account/PACE Key | (CS Only) |

| Life of Line/Info | 40 | Text | Life of Line/Special Info | (CS Only) |

| See Form Common Fields | Form fields common to all form types. | |||

1099-R Form:

IRS 1099-R Form: 1099-R 2020 Form

IRS 1099-R Instructions: 1099-R 2020 Instructions

Overview

Content Tools