- Loading...

IRS Release Status: FINAL

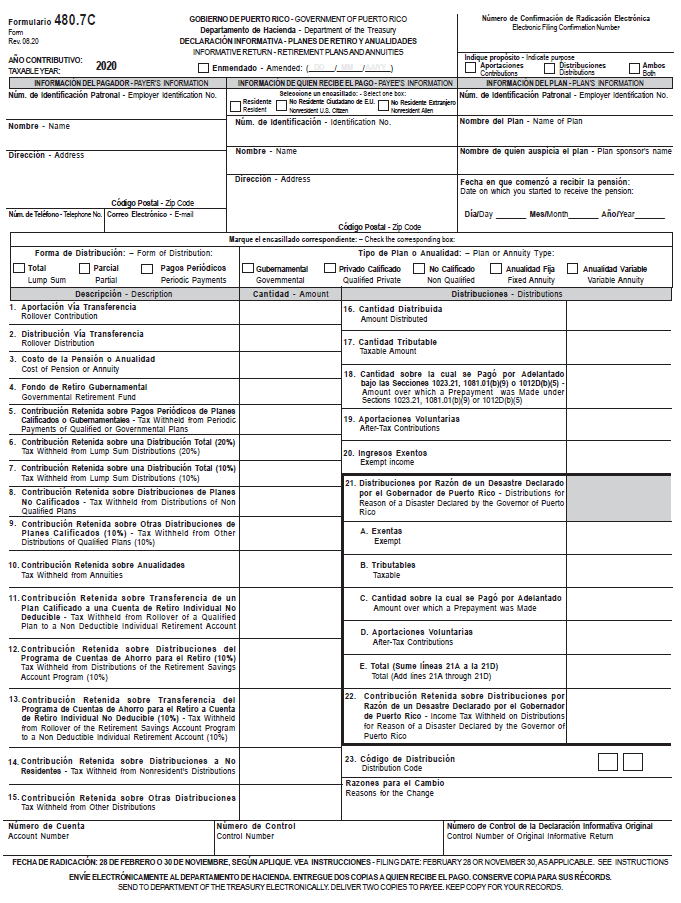

Sample Import Template File: 480.7C Sample Excel Import TY2020.xls

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Form Lump Sum Checkbox | 1 | Checkbox | Form of distribution is lump sum | X / Y / T / 1 = Checked |

Form Partial Checkbox | 1 | Checkbox | Form of distribution is partial | X / Y / T / 1 = Checked |

| Form Periodic Payments Checkbox | 1 | Checkbox | Form of distribution is period payments | X / Y / T / 1 = Checked |

Plan Governmental Checkbox | 1 | Checkbox | Plan or annuity type is governmental | X / Y / T / 1 = Checked |

| Plan Qualified Private Checkbox | 1 | Checkbox | Plan or annuity type is qualified private | X / Y / T / 1 = Checked |

| Plan Non Qualified Checkbox | 1 | Checkbox | Plan or annuity type is non qualified | X / Y / T / 1 = Checked |

| Plan Fixed Annuity Checkbox | 1 | Checkbox | Plan or annuity type is fixed annuity | X / Y / T / 1 = Checked |

| Plan Variable Annuity Checkbox | 1 | Checkbox | Plan or annuity type is variable annuity | X / Y / T / 1 = Checked |

| Pension Start Date | 8 | Date | Date you started receiving the pension | MM/DD/YYYY or M/D/YYYY |

| Payee Resident | 1 | Checkbox | Payee Resident | X / Y / T / 1 = Checked |

| Payee Nonresident U.S. Alien | 1 | Checkbox | Payee Nonresident U.S. Alien | X / Y / T / 1 = Checked |

| Payee Nonresident Alien | 1 | Checkbox | Payee Nonresident Alien | X / Y / T / 1 = Checked |

| Box 1 Amount | 12 | Amount | Rollover contribution | |

| Box 2 Amount | 12 | Amount | Rollover distribution | |

| Box 3 Amount | 12 | Amount | Annuity cost | |

| Box 4 Amount | 12 | Amount | Governmental retirement fund | |

| Box 5 Amount | 12 | Amount | Tax w/h from annuity or periodic payment | |

| Box 6 Amount | 12 | Amount | Tax w/h from lump sum distrib (20%) | |

| Box 7 Amount | 12 | Amount | Tax w/h from lump sum distrib (10%) | |

| Box 8 Amount | 12 | Amount | Tax w/h from lump sum distrib (8%) | |

| Box 9 Amount | 12 | Amount | Tax w/h other distrib qual plans (10%) | |

| Box 10 Amount | 12 | Amount | Tax w/h from dist of non-qual plans | |

| Box 11 Amount | 12 | Amount | Tax w/h rollover to non deduct IRA | |

| Box 12 Amount | 12 | Amount | Tax w/h retire savings acct dist (10%) | |

| Box 13 Amount | 12 | Amount | Tax w/h roll rsa to non ded ira (10%) | |

| Box 14 Amount | 12 | Amount | Tax w/h nonresident distribution | |

| Box 15 Amount | 12 | Amount | Tax w/h other distribution | |

| Box 16 Amount | 12 | Amount | Amount distributed | |

| Box 17 Amount | 12 | Amount | Taxable amount | |

| Box 18 Amount | 12 | Amount | Amt over which prepayment made | |

| Box 19 Amount | 12 | Amount | After-tax contributions | |

| Box 20 Amount | 12 | Amount | Exempt Income | |

| Box 21a Amount | 12 | Amount | Distribution deferred contributions | |

| Box 21b Amount | 12 | Amount | Distribution after-tax contributions | |

| Box 21c Amount | 12 | Amount | Distribution income accretion | |

| Box 21d Amount | 12 | Amount | Distribution others | |

| Box 21e Amount | 12 | Amount | Dist total (lines 19a through 19d) | |

| Box 22 Amount | 12 | Amount | Income tax withheld on eligible distributions for reason of extreme economic emergency due to declared disaster | |

| Box 23 Code Box 1 | 1 | Text | Distribution code | Values: A,B,C,D,E,F,G,H,I,J,K,L,M,N allowed only |

| Box 23 Code Box 2 | 1 | Text | Distribution code | Values: A,B,C,D,E,F,G,H,I,J,K,L,M,N allowed only |

| See Form Common Fields | Form fields common to all form types. | |||

Form 480.7C:

Hacienda form and instructions: 480.7c_2020_informativo.pdf

Overview

Content Tools