- Loading...

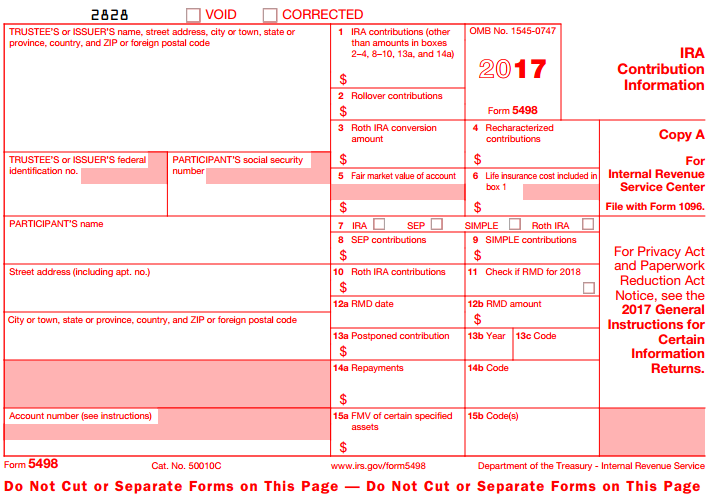

IRS Release Status: FINAL

Sample Excel Import File: 5498 2017.xlsx

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Box 1 Amount | 12 | Amount | Box 1: IRA contributions (other than amounts in...) | |

| Box 2 Amount | 12 | Amount | Box 2: Rollover contributions | |

Box 3 Amount | 12 | Amount | Box 3: Roth IRA conversion amount | |

Box 4 Amount | 12 | Amount | Box 4: Recharacterized contributions | |

| Box 5 Amount | 12 | Amount | Box 5: Fair market value of account | |

Box 6 Amount | 12 | Amount | Box 6: Life insurance cost included in box 1 | |

| Box 7 Checkbox 1 | 1 | Checkbox | Box 7: IRA | X / Y / T / 1 = Checked |

| Box 7 Checkbox 2 | 1 | Checkbox | Box 7: SEP | X / Y / T / 1 = Checked |

| Box 7 Checkbox 3 | 1 | Checkbox | Box 7: SIMPLE | X / Y / T / 1 = Checked |

| Box 7 Checkbox 4 | 1 | Checkbox | Box 7: Roth IRA | X / Y / T / 1 = Checked |

| Box 8 Amount | 12 | Amount | Box 8: SEP contributions | |

| Box 9 Amount | 12 | Amount | Box 9: SIMPLE contributions | |

| Box 10 Amount | 12 | Amount | Box 10: Roth IRA contributions | |

| Box 11 Checkbox | 1 | Checkbox | Box 11: Check if RMD for 2016 | X / Y / T / 1 = Checked |

| Box 12a Date | 10 | Date | Box 12a: RMD date | MM/DD/YYYY or M/D/YYYY |

| Box 12b Amount | 12 | Amount | Box 12b: RMD amount | |

| Box 13a Amount | 12 | Amount | Box 13a: Postponed contribution | |

| Box 13b Year | 4 | Numeric | Box 13b: Year | |

| Box 13c Code | 8 | Text | Box 13c: Code | E012744 / E013119 / E013239 / FD / PL106-21 |

| Box 14a Amount | 12 | Amount | Box 14a: Repayments | |

| Box 14b Code | 2 | Text | Box 14b: Code | DD / QR |

| Box 15a Amount | 12 | Amount | Box 15a: FMV of certain specified assets | |

| Box 15b Code | 2 | Text | Box 15b: Code(s) | See IRS Instructions |

| See Form Common Fields | Form fields common to all form types. | |||

5498 Form:

IRS 5498 Form: 5498 Form

IRS 5498 Instructions: 5498 Instructions

Overview

Content Tools