You are viewing an old version of this page. View the current version.

Compare with Current

View Page History

« Previous

Version 2

Next »

IRS Release Status:PENDING

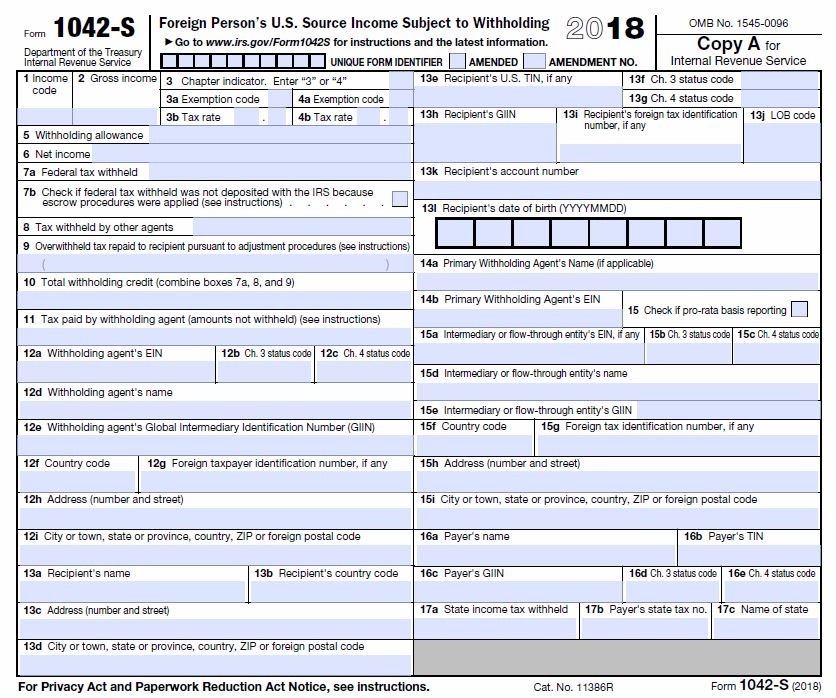

Sample Excel Import File: 1042-S

What's New for 2017

- Unique form identifier. Beginning in 2017, withholding agents will be required to assign a unique identifying number to each Form 1042-S they file. This identifying number is used, for example, to identify which information return is being corrected or amended when multiple information returns are filed by a withholding agent with respect to the same recipient. The unique identifying number cannot be the recipient's U.S. or foreign TIN. The unique identifying number must be numeric. The length of a given identifying number must be exactly 10 digits. The identifying number must be unique to each original Form 1042‐S filed for the current year. The identifying number can be used on a new original form in a subsequent year.

- Amended forms. Beginning in 2017, withholding agents filing an amended form must indicate the amendment number (see top of form below title, to the right of the “Amended” checkbox). Any amended form must have the same unique form identifier as the original form that is being amended. Each time that you amend the same form (as determined by the unique form identifier), you must provide the amendment number in the box provided on the form (using “1” for the first amendment and increasing sequentially for each subsequent amendment). See Amended Forms, later, for more information.

- Pro-rata reporting. The “Pro-Rata Reporting” box was moved from the top of the form (below the title) down to new box 15.

- Qualified derivatives dealers (QDDs). To facilitate implementation of the withholding requirements associated with QDDs, the instructions add a new chapter 3 exemption code that applies for payments to a QDD and a new chapter 3 status code for a QDD. For more information on the use of these codes, see Boxes 3a and 4a, Chapter 3 and Chapter 4 Exemption Codes, and Boxes 13f and 13g, Recipient's Chapter 3 and Chapter 4 Status Codes, later. For more information on the withholding and reporting requirements associated with payments made to and by QDDs, see Revenue Procedure 2017-15.

- Codes Changes.The 2017 Form 1042-S includes new pooled reporting codes 36, 37, and 38 (related to dividend equivalent offsetting payments) as well as existing code 33 (for joint account withholding rate pools). Based on the final QI agreement applicable for 2017 (Revenue Procedure 2017-15), these codes are no longer valid and withholding agents should not use these codes for Form 1042-S reporting purposes. These instructions were issued subsequent to the form and the four codes in question are included on page 22 of these instructions, but with the notation that they are not to be used. The four codes in question will be removed from the 2018 form. Also note that parts of footnote 9 have been amended in these instructions. This change will also be made to the 2018 form.

- Other changes to codes. Income code 54 has been changed from “Other income” to “Substitute payments - interest from certain actively traded or publicly offered securities.” Withholding agents should use income code 23 (Gross income - Other) to report payments of income for which no other income code applies. Withholding agents should use code 54 to report payments of interest on actively traded or publicly offered securities if the interest is described in Treasury Regulations section 1.1441-6(c)(2) and the withholding agent reduced the rate of withholding under an income tax treaty. A chapter 4 exemption code has been added for payments that are not subject to chapter 4 withholding and for CAUTION ! which no other chapter 4 exemption code applies. For more information on using this exemption code, see Boxes 3a and 4a, Chapter 3 and Chapter 4 Exemption Codes, later. The chapter 4 exemption codes for excluded payments on offshore obligations and collateral have been removed as these exemptions do not apply after the 2016 calendar year. See Treasury Regulations section 1.1473-1(a)(4)(vi) and (vii). The chapter 4 status codes for limited FFIs and branches that are treated as nonparticipating FFIs have also been removed as these are not valid statuses for purposes of chapter 4 after the 2016 calendar year. See Notice 2015-66.

- List of foreign country codes. Beginning in 2017, Form 1042-S filers will use the same list of country codes used on other IRS forms (for example, Forms 926, 1118, 3520, and 8805). This list of foreign country codes may be found at www.irs.gov/countrycodes. Note. Although the list of country codes is maintained by Modernized e-File, Form 1042-S filers who file electronically will continue to use the FIRE system. See instructions for Electronic Reporting on page 3. Also, if applicable, the option to file Form 1042-S by paper is still available.

- Foreign taxpayer identifying number and date of birth. Beginning in 2017, a financial institution that files a Form 1042-S with respect to a payment on an obligation that it maintains at its U.S. office or U.S. branch must report the recipient's foreign taxpayer identifying number (FTIN) and date of birth (if the recipient is an individual). See Box 13i, Recipient's Foreign Taxpayer Identifying Number, and Box 13l, Recipient's Date of Birth, later, for additional information regarding this requirement.

- Amount repaid to recipient. The instructions now clarify that a withholding agent that repays overwithheld tax to a recipient under the set-off procedure should report the repayment in box 11 if the repayment is made in the year following the calendar year of overwithholding. See Box 11, Amount Repaid to Recipient, later, and the instructions to Form 1042 for more information

- Recipient’s U.S. TIN Type to Reserved. (Removed)

- U.S. Federal Tax Withheld Indicator to Reserved. (Removed)

| Field Name | Size | Type | Description | Notes |

|---|

| See Form Filer Common Fields | Filer fields common to all form types. |

|

| See Recipient Common Fields | Recipient fields common to all form types. |

|

| Unique Form ID | 10 | Numeric | Unique Form Identifier | A withholding agent must provide a unique form identifier number on each Form 1042-S that it files in the box provided at the top of the form. The unique form identifier must: Be numeric (for example, 1234567891), Be exactly 10 digits, and Not be the recipient's U.S. or foreign TIN. The 1042-S software will auto-assign Unique Form Identifiers if they are not included in the import file. |

| Box 1 Code | 2 | Text | Income Code | See IRS instructions |

Box 2 Amount | 12 | Amount | Gross Income |

|

Box 3 Checkbox | 1 | Checkbox | Chapter 3 Indicator | X / Y / T / 1 = Checked |

| Box 3a Code | 2 | Text | Chapter 3 Exemption Code | See IRS instructions |

| Box 3b Number | 4 | Numeric | Chapter 3 Tax Rate | Tax Rate as a two-digit whole number and two-digit decimal |

| Box 4 Checkbox | 1 | Checkbox | Chapter 4 Indicator | X / Y / T / 1 = Checked |

| Box 4a Code | 2 | Text | Chapter 4 Exemption Code | See IRS instructions |

| Box 4b Number | 4 | Numeric | Chapter 4 Tax Rate | Tax Rate as a two-digit whole number and two-digit decimal |

| Box 5 Amount | 12 | Amount | Withholding Allowance |

|

| Box 6 Amount | 12 | Amount | Net Income |

|

| Box 7a Amount | 12 | Amount | Federal Tax Withheld |

|

| Box 7b Checkbox | 1 | Checkbox | Check if tax not deposited with IRS pursuant to escrow prodecure |

|

Box 8 Number | 12 | Amount | Tax withheld by other agents |

|

| Box 9 Amount | 12 | Amount | Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions) |

|

| Box 11 Amount | 12 | Amount | Tax paid by Withholding Agent |

|

| Box 12b Code | 2 | Text | Withholding Agent's Chapter 3 Status Code . | See IRS instructions |

| Box 12c Code | 2 | Text | Withholding Agent's Chaper 4 Status Code | See IRS instructions |

| Box 13b Code | 2 | Text | Recipient's Country Code | See IRS instructions |

Box 13e TIN | 11 | Number | Recipient's U.S. TIN, if any |

|

| Box 13f Code | 2 | Text | Recipient Chaper 3 status code | See IRS instructions |

| Box 13g Code | 2 | Text | Recipient Chaper 4 status code | See IRS instructions |

| Box 14a Name | 40 | Text | Primary Withholding Agent's Name (if applicapable) |

|

| Box 14b TIN | 11 | Number | Primary Withholding Agent's EIN |

|

| Box 15 Checkbox | 1 | Checkbox | Pro-rata Basis Chkbx | Pro-rata Reporting See IRS instructions |

| Box 15a TIN | 11 | Number | Intermediary flow-through's name |

|

| Box 15b Code | 2 | Text | Intermediary’s or FTE’s Chapter 3 Status Code | See IRS instructions |

| Box 15c Code | 2 | Text | Intermediary’s or FTE’s Chapter 4 Status Code | See IRS instructions |

| Box 15d Name | 40 | Text | Intermediary/Flow-Through's Name |

|

| Box 15e GIIN | 19 | Text | Intermediary or FTE GIIN | Global Intermediary identification Number (GIIN) |

| Box 15f Code | 2 | Text | NQI/FLW-THR/PTP Country Code | See IRS instructions |

| Box 15g TIN | 22 | Text | Recipient’s Foreign Tax I.D. Number |

|

| Box 15h Address | 40 | Text | NQI/FLW-THR/PTP Address Line-1 |

|

| 40 | Text | NQI/FLW-THR/PTP Address Line-2 |

|

| Box 15i City | 40 | Text | NQI/FLW-THR/PTP City |

|

| Box 16a Name | 40 | Text | Payer's Name |

|

| Box 16b TIN | 11 | Text | Payer's TIN |

|

| Box 16c GIIN | 19 | Text | Payer's GIIN |

|

| Box 16d Code | 2 | Text | Payer's Chapter 3 Status Code | See IRS instructions |

| Box 16e Code | 2 | Text | Payer's Chapter 4 Status Code | See IRS instructions |

| Box 17a Amount | 12 | Amount | State income tax withheld |

|

| Box 17b State No. | 10 | Text | Payer's State Tax Number |

|

| Box 17c State | 2 | Text | Payer's State Code | See IRS instructions |

See Form Common Fields | Form fields common to all form types. |

|