- Loading...

IRS Release Status: PENDING

Sample Excel Import File: Coming soon!

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

Box 1 Amount | 12 | Amount | Box 1: Patronage dividends | |

Box 2 Amount | 12 | Amount | Box 2: Nonpatronage dividends | |

Box 3 Amount | 12 | Amount | Box 3: Per-unit retain allocations | |

| Box 4 Amount | 12 | Amount | Box 4: Federal income tax withheld | |

| Box 5 Amount | 12 | Amount | Box 5: Redeemed nonqualified notices | |

| Box 6 Amount | 12 | Amount | Box 6: Section 199A(g) deduction | |

| Box 7 Amount | 12 | Amount | Box 7: Qualified payments (Section 199A(b)(7)) | |

| Box 8 Amount | 12 | Amount | Box 8: Section 199A(a) qual. items | |

| Box 9 Amount | 12 | Amount | Box 9: Section 199A(a) SSTB items | |

| Box 10 Amount | 12 | Amount | Box 10: Investment credit | |

| Box 11 Amount | 12 | Amount | Box 11: Work opportunity credit | |

| Box 12 Amount | 12 | Amount | Box 12: Other credits and deductions | |

| Box 12 Credit Form | 6 | Text | Box 12: Credit form description | |

| Box 13 Checkbox | 1 | Checkbox | Box 13: Specified Coop | |

| See Form Common Fields | Form fields common to all form types. | |||

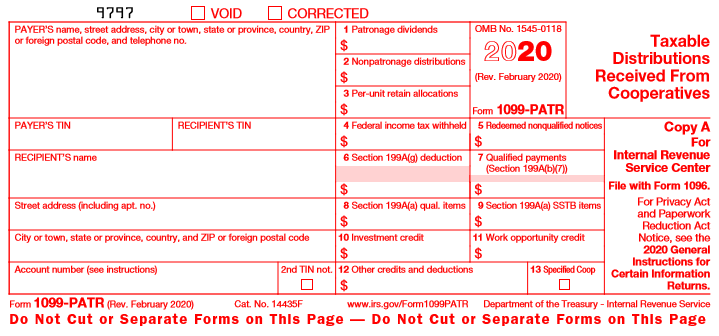

1099-PATR Form:

IRS 1099-PATR Form: 1099-PATR 2020 Form

IRS 1099-PATR Instructions: 1099-PATR 2020 Instructions

Overview

Content Tools