- Loading...

IRS Release Status: FINAL

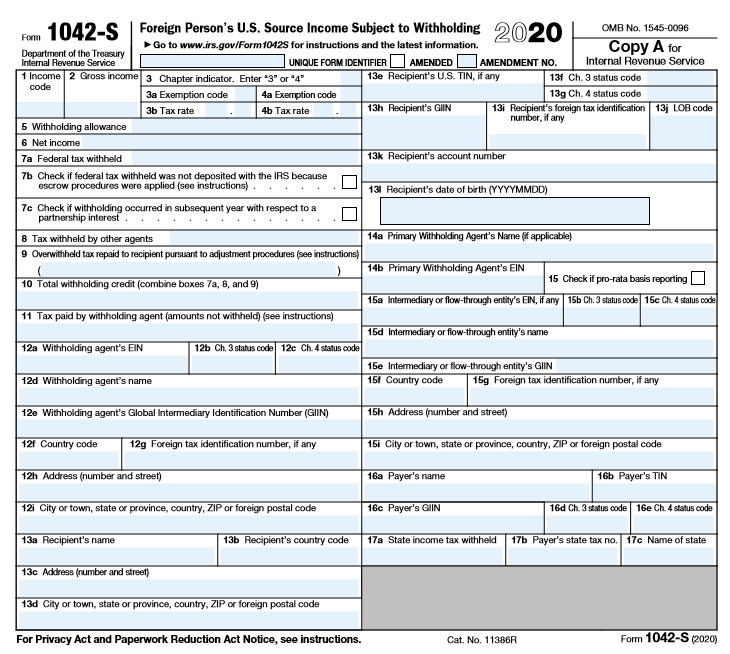

Sample Excel Import File: 1042-S Sample Excel Import TY2020.xls

Import Form Fields:

| Field Name | Size | Type | Description | Notes |

|---|---|---|---|---|

| See Form Filer Common Fields | Filer fields common to all form types. | |||

| See Recipient Common Fields | Recipient fields common to all form types. | |||

| Unique Form ID | 10 | Numeric | Unique Form Identifier | A withholding agent must provide a unique form identifier number on each Form 1042-S that it files in the box provided at the top of the form. The unique form identifier must: Be numeric (for example, 1234567891), Be exactly 10 digits, and Not be the recipient's U.S. or foreign TIN. The 1042-S software will auto-assign Unique Form Identifiers if they are not included in the import file. |

| Box 1 Code | 2 | Text | Box 1: Income Code | See IRS instructions |

Box 2 Amount | 12 | Amount | Box 2: Gross Income | |

Box 3 Chap 3 Chk | 1 | Checkbox | Chapter 3 Indicator | X / Y / T / 1 = Checked |

| Box 3a Exempt Code | 2 | Text | Box 3a: Chapter 3 Exemption Code | See IRS instructions |

| Box 3b Tax Rate | 4 | Numeric | Box 3b: Chapter 3 Tax Rate | Tax Rate as a two-digit whole number and two-digit decimal |

| Box 4 Chap 4 Chk | 1 | Checkbox | Chapter 4 Indicator | X / Y / T / 1 = Checked |

| Box 4a Exempt Code | 2 | Text | Box 4a: Chapter 4 Exemption Code | See IRS instructions |

| Box 4b Tax Rate | 4 | Numeric | Box 4b: Chapter 4 Tax Rate | Tax Rate as a two-digit whole number and two-digit decimal |

| Box 5 Amount | 12 | Amount | Box 5: Withholding Allowance | |

| Box 6 Amount | 12 | Amount | Box 6: Net Income | |

| Box 7 Amount | 12 | Amount | Box 7: Federal Tax Withheld | |

| Not Escrow Checkbox | 1 | Checkbox | Box 7b: Check if tax not deposited with IRS pursuant to escrow procedure | X / Y / T / 1 = Checked |

| Box 7c Check | 1 | Checkbox | Box 7c: Withholding occurred in subsequent year for a partnership interest | X / Y / T / 1 = Checked |

Box 8 Amount | 12 | Amount | Box 8: Tax withheld by other agents | |

| Box 9 Amount | 12 | Amount | Box 9: Overwithheld tax repaid to recipient pursuant to adjustment procedures (see instructions) | |

| Box 11 Amount | 12 | Amount | Box 11: Tax paid by Withholding Agent | |

| WHA Ch3 Status | 2 | Text | Box 12b: Withholding Agent's Chapter 3 Status Code | See IRS instructions |

| WHA Ch4 Status | 2 | Text | Box 12c: Withholding Agent's Chapter 4 Status Code | See IRS instructions |

| Rcp Tax Country Name | 12 | Text | Box 13b: Recipient's Country Name | See IRS instructions |

Box 13e TIN | 11 | Number | Box 13e: Recipient's U.S. TIN, if any | |

| Rcp Ch3 Status | 2 | Text | Box 13f: Recipient Chapter 3 status code | See IRS instructions |

| Rcp Ch4 Status | 2 | Text | Box 13g: Recipient Chapter 4 status code | See IRS instructions |

| Box 14a Primary Name | 40 | Text | Box 14a: Primary Withholding Agent's Name (if applicable) | |

| Box 14b Primary EIN | 11 | Number | Primary Withholding Agent's EIN | |

| Box 14b Primary Type | 1 | Character | Box 14b: Primary Type | Character EIN=1, SSN=2, Unknown type=0 or blank |

| Pro-rata Basis Chkbx | 1 | Checkbox | Box 15 Checkbox: Pro-rata Basis Chkbx | X / Y / T / 1 = Checked. Pro-rata Reporting. See IRS instructions |

| Box 15a I/FTE EIN | 11 | Number | Box 15a TIN: Intermediary flow-through's EIN | Intermediary or flow-through TIN if known or blank if unknown |

| Box 15b I/FTE Ch3 | 2 | Text | Box 15b Code: Intermediary’s or FTE’s Chapter 3 Status Code | See IRS instructions |

| Box 15c I/FTE Ch4 | 2 | Text | Box 15c Code: Intermediary’s or FTE’s Chapter 4 Status Code | See IRS instructions |

| Box 15d I/FTE Name 1 | 40 | Text | Box 15d Name: Intermediary/Flow-Through's Name | |

| Box 15e I/FTE GIIN | 19 | Text | Box 15e GIIN: Intermediary or FTE GIIN | Global Intermediary identification Number (GIIN) |

| Box 15f Country Name | 12 | Text | Box 15f: NQI/FLW-THR/PTP Country Name | See IRS instructions |

| Box 15g Foreign TIN | 22 | Text | Box 15g TIN: Recipient’s Foreign Tax I.D. Number | |

| Box 15h I/FTE Addr 1 | 40 | Text | Box 15h Address: NQI/FLW-THR/PTP Address Line-1 | |

| Box 15h I/FTE Addr 2 | 40 | Text | NQI/FLW-THR/PTP Address Line-2 | |

| Box 15d I/FTE Name 2 | 40 | Text | Box 15d Name 2: Intermediary/Flow-Through's Name | |

| Box 15d I/FTE Name 3 | 40 | Text | Box 15d Name 3: Intermediary/Flow-Through's Name | |

| Box 15i I/FTE City | 40 | Text | Box 15i City: Intermediary/Flow-Through's City | |

| Box 15i State/Prov | 2 | Character | Box 15i State/Prov: Intermediary/Flow-Through's US State or province | |

| Box 15i Zip/Postal | 10 | Character | Box 15i Zip/Postal: Intermediary/Flow-Through's Zip/Postal | |

| Box 16a Payer's Name | 40 | Text | Box 16a Name: Payer's Name | |

| Box 16b Payer's TIN | 11 | Text | Box 16b TIN: Payer's TIN | |

| Box 16c Payer's GIIN | 19 | Text | Box 16c GIIN: Payer's GIIN | |

| Box 16d Payer's Ch3 | 2 | Text | Box 16d Code: Payer's Chapter 3 Status Code | See IRS instructions |

| Box 16e Payer's Ch4 | 2 | Text | Box 16e Code: Payer's Chapter 4 Status Code | See IRS instructions |

| Box 17a Amount | 12 | Amount | Box 17a Amount: State income tax withheld | |

| Box 17b State Tax No. | 10 | Text | Box 17b: Payer's State Tax Number | |

| Box 17c State | 2 | Text | Box 17c: Payer's US State/Canadian province | See IRS instructions |

| Form fields common to all form types. | ||||

1042-S Form:

IRS 1042-S Form: 1042-S 2020 Form

IRS 1042-S Instructions: 1042-S 2020 Instructions

1042-S Correction of a Correction Walk Through Guidebook PDF download

Overview

Content Tools