- Loading...

Release Notes

This is the Early Release of 1042-S Pro for 2015.

*Please refer to IRS instructions for full detail of 2015 changes (http://www.irs.gov/pub/irs-pdf/i1042s.pdf)

UPDATED:

- Built in reports have been updated form the box changes.

- All default maps and sample import files have been updated for 2015.

- Print layouts for all copies have been updated for 2015.

- All help files have been updated for 2015

FORM CHANGES:

- Renumbered boxes for 2015.

- New & changed IRS codes.

Note the changes and modifications listed below is not a comprehensive listing and is subject to change. We strongly recommend that you have your legal and accounting departments research the new codes.

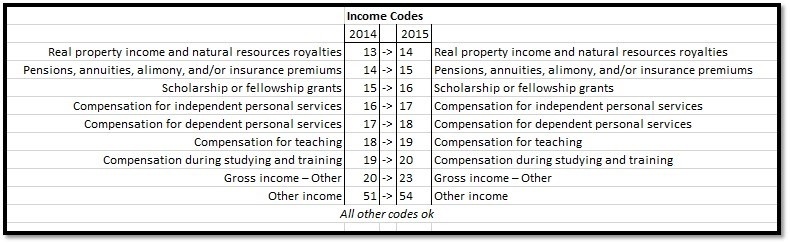

Income Codes

New:

13 - Royalties paid on certain publicly offered securities

51 - Interest paid on certain actively traded or publicly offered securities

52 - Dividends paid on certain actively traded or publicly offered securities

53 - Substitute payments- dividends from certain actively traded or publicly offered securities

2014->2015 Changes:

Exemption Codes

New:

Chp 3: 22- Excluded Payments on Collateral

2014->2015 Changes

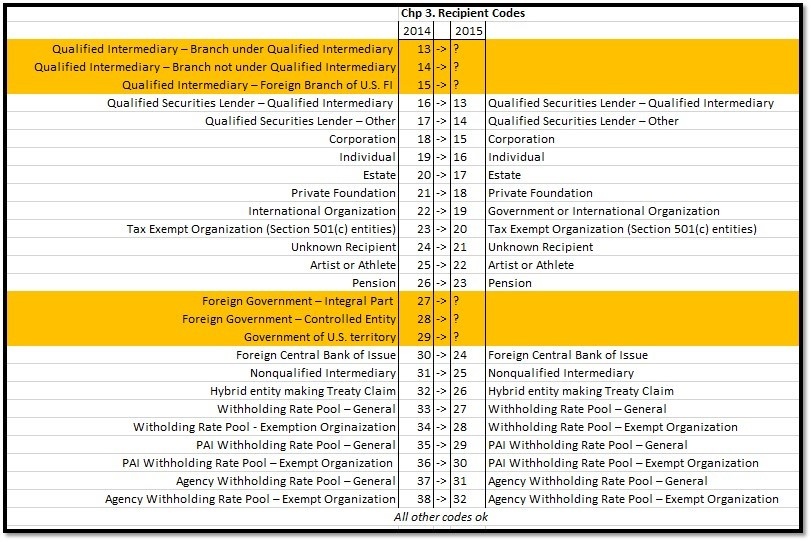

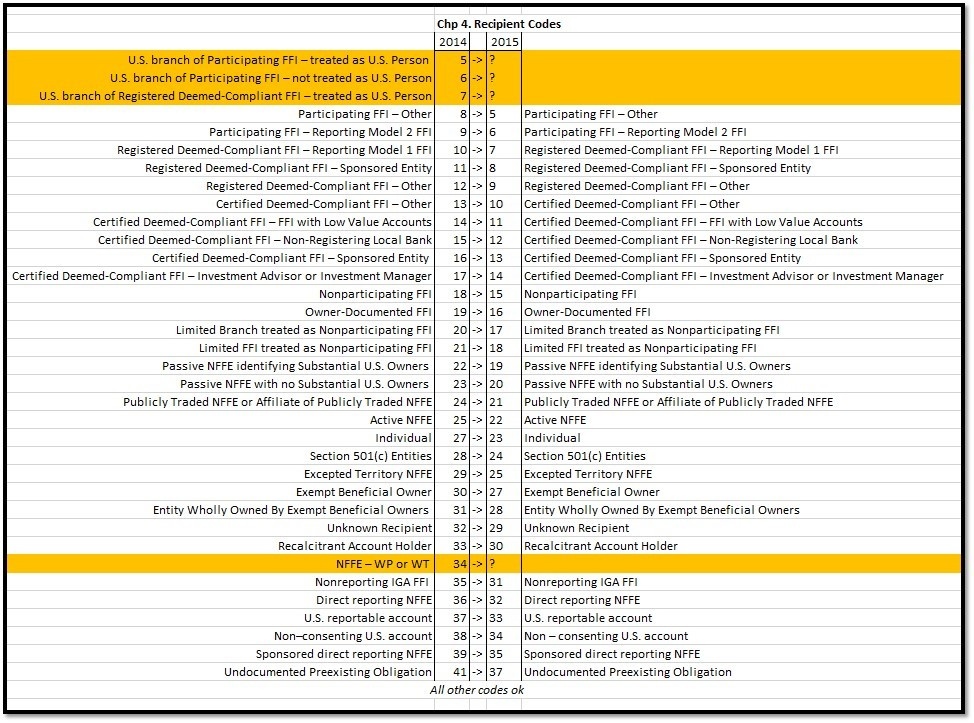

Recipient Codes

New:

33 - Joint Account Withholding Rate Pool

2014->2015 Changes

Excerpt from the IRS re: What's New

Account-by-account reporting for U.S. financial institutions. For amounts paid on or after January 1, 2016, a U.S. financial institution will be required to report payments of the same type of income (as determined by the Income code in box 1) made to multiple financial accounts held by the same beneficial owner on separate Forms 1042-S for each account.

Expired tax provisions. On page 8, the section pertaining to “Withholding on Dispositions of U.S. Real Property Interests by Publicly Traded Trusts and Qualified Investment Entities (QIEs)” has been amended in accordance with the termination provision of section 897(h)(4) (A)(ii). In the past, Congress has extended the applicability of section 897(h)(4)(A)(i)(II). You can find out whether legislation has extended the applicability of this section at www.irs.gov/form1042s.

List of foreign country codes. The list of foreign country codes has been removed from these instructions. Filers must now use the list of country codes at IRS.gov. A list of foreign countries with which the United States has an income tax treaty is also available at IRS.gov. If more information concerning these lists becomes available after these instructions are published, it will be posted at www.irs.gov/form1042s

References:

Publication 1187 see http://www.irs.gov/pub/irs-pdf/p1187.pdf

2014 1042-S Instructions: http://www.irs.gov/pub/irs-pdf/i1042s.pdf

Publication 515 Withholding on Tax on Nonresident Aliens and Foreign Entities http://www.irs.gov/pub/irs-pdf/p515.pdf