- Loading...

Release Notes

IMPORTANT: You will need a 2018 Authorization Code starting with the letter 'B' BEFORE installing this update!

NEW: 2018 Forms are now available

Please select the below links for a complete description of all the IRS form updates.

- Form 1098: 1098 2018

- Form 1098-T: 1098-T 2018

- Form 1099-DIV: 1099-DIV 2018

- Form 1099-R: 1099-R 2018

- Form 5498: 5498 2018

- Form 1042-S: 1042-S 2018

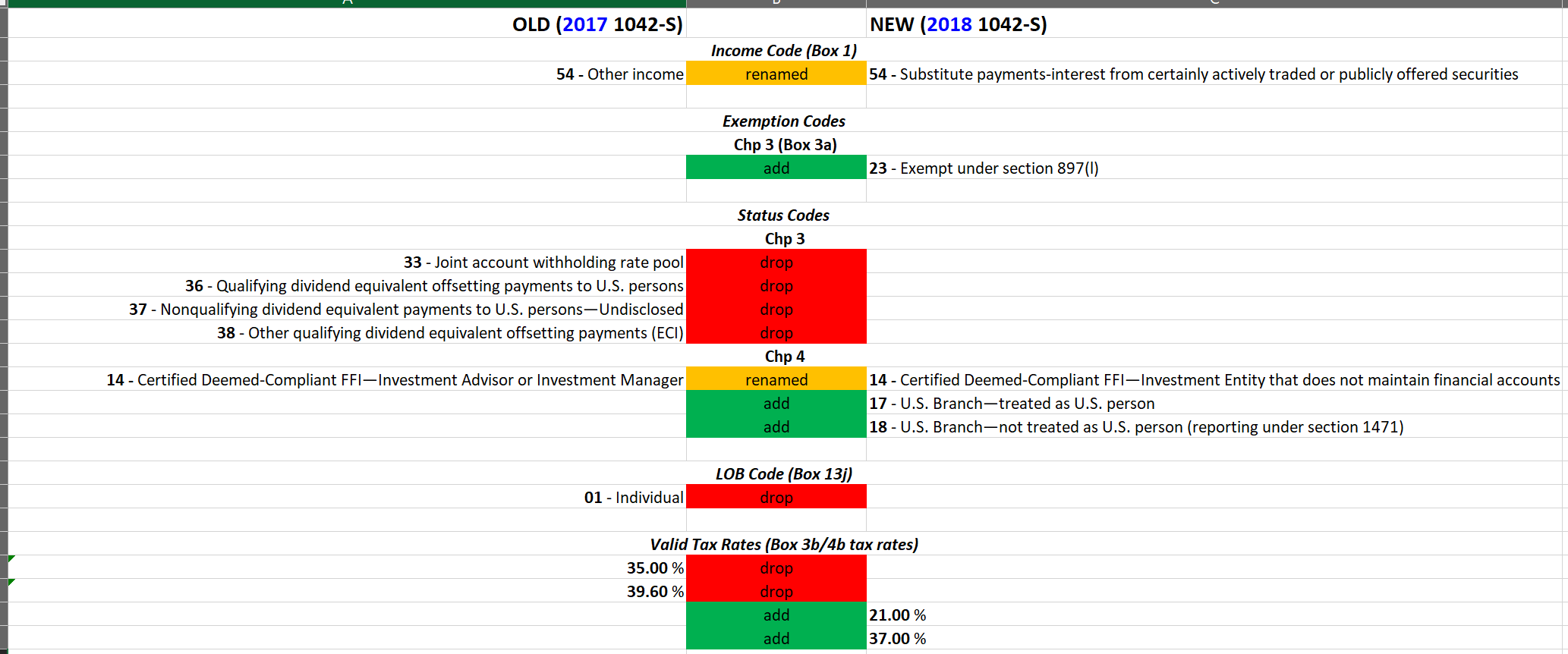

IMPORTANT: Please review the following 2018 1042-S code changes and make any required changes to your data or imports. - W-2: W-2 2018

- W-2G: W-2G 2018

- Form 1098: 1098 2018

NEW: All final 2018 IRS PDF's & Instructions included.

NEW: 2018 samples files are included. A complete set can be found here - 2018 Tax Year - Import Templates and Maps

NEW: Unfiled Forms summary report. This report breaks down filed vs. unfiled forms for original forms and corrections forms, respectively.

NEW: User preference option added to convert TINs of all zeroes to blanks on import. This option can be found in Security & Administration → Rules & Options → 1099/W-2/1042-S Update Preferences

NEW: Pro Central home screen that provides high level task overview, due dates, and links to help videos or services.

NEW: GPF reporting is turned on to help troubleshoot when software encounters errors during use.

NEW: Filer State ID now cascades to all Filer with matching TIN.

UPDATED: 2018 W-2 maxiumum/limits.

UPDATED: Latest GIIN list included.

UPDATED: Visual enhancements to overall user interface.

UPDATED: Business rules are updated for the 2018 form changes.

UPDATED: Comprehensive help file is overhauled.

UPDATED: Scheduler, Forms and Report Manager services updated to log more information.

UPDATED: The electronic filing module has been activated for creating electronic files for submission to the IRS/SSA.

UPDATED: W-2G withholding options updated.

UPDATED: Puerto Rico e-file session tracking simplified.

FIXED: W-2 state control totals report was printing an extra page.

FIXED: Recipient report on large volume of recipients was processing slow.

FIXED: Length of W-2 G boxes was short than the 1220 specifications.

FIXED: Recipient email address was not flowing to the form on manual entry selection.

FIXED: Recipient import was not importing the Recipient Type.

FIXED: Filer import was not importing Canadian address type.

FIXED: Form 3922 extended control totals report was overlapping sum amounts.

FIXED: Filer country code import was not populating correctly.

FIXED: Security reports was reporting incorrect date ranges.

FIXED: Simplified preferences and options menu in Security & Administration.

FIXED: Correction type was displayed incorrectly in manual correction mode.

FIXED: Custom state threshold rules were not able to be edited.

FIXED: Recipient changes were not cascading to eligible forms correctly.

A number of other small fixes and enhancements are also included in this release.