- Loading...

Release notes

IMPORTANT: This update has been temporarily removed. 1099 Pro will be issuing another update, by EOD 1/13/21, to replace it. Thank you!

NEW:

- Service Bureau - Now enabled for printing/mailing, electronic filing, and Bulk TIN uploads

- Service Bureau - A brand new 1099-NEC State Direct Reporting feature has been added. For complete details, additional pricing, and important limitations, please see - Service Bureau - State Reporting Details.

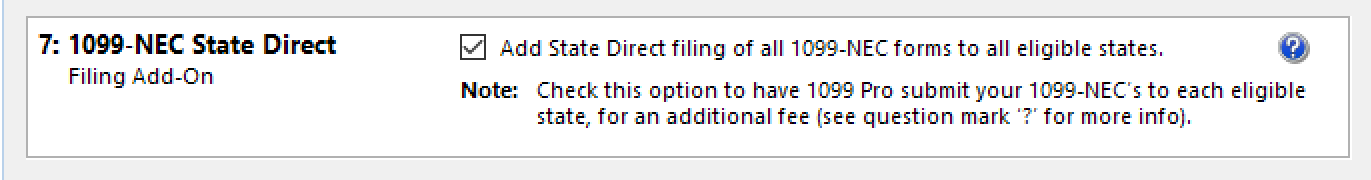

- Example: Add-On checkbox during a Service Bureau "Print, Mail, and File" upload or a Service Bureau "Electronic Filing" upload.

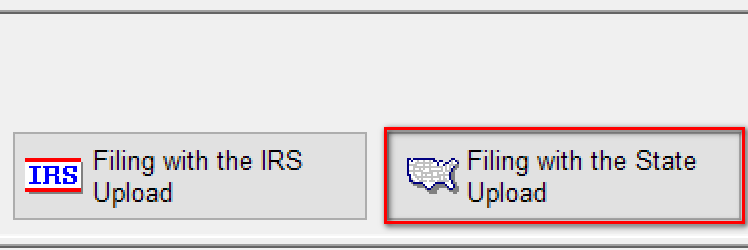

- Example: Service Bureau "Filing with the State Upload" new upload type. Use this option for only submitting 1099-NEC state direct files.

- Example: Add-On checkbox during a Service Bureau "Print, Mail, and File" upload or a Service Bureau "Electronic Filing" upload.

- Electronic Filing - Now enabled for all forms (Enterprise Only).

- Paper Filing - Now enabled for all forms.

- State Electronic Filing - Now enabled for all forms (Enterprise Only).

- The 1099-NEC is also supported via Enterprise's state filing features.

- Additionally, the 1099-NEC (only the 1099-NEC) has state specific thresholds built-in which will filter out records that states do not want reported (such as states that only want records that show state tax withheld).

- For a complete list of each state's reporting thresholds, please see - Service Bureau - State Reporting Details.

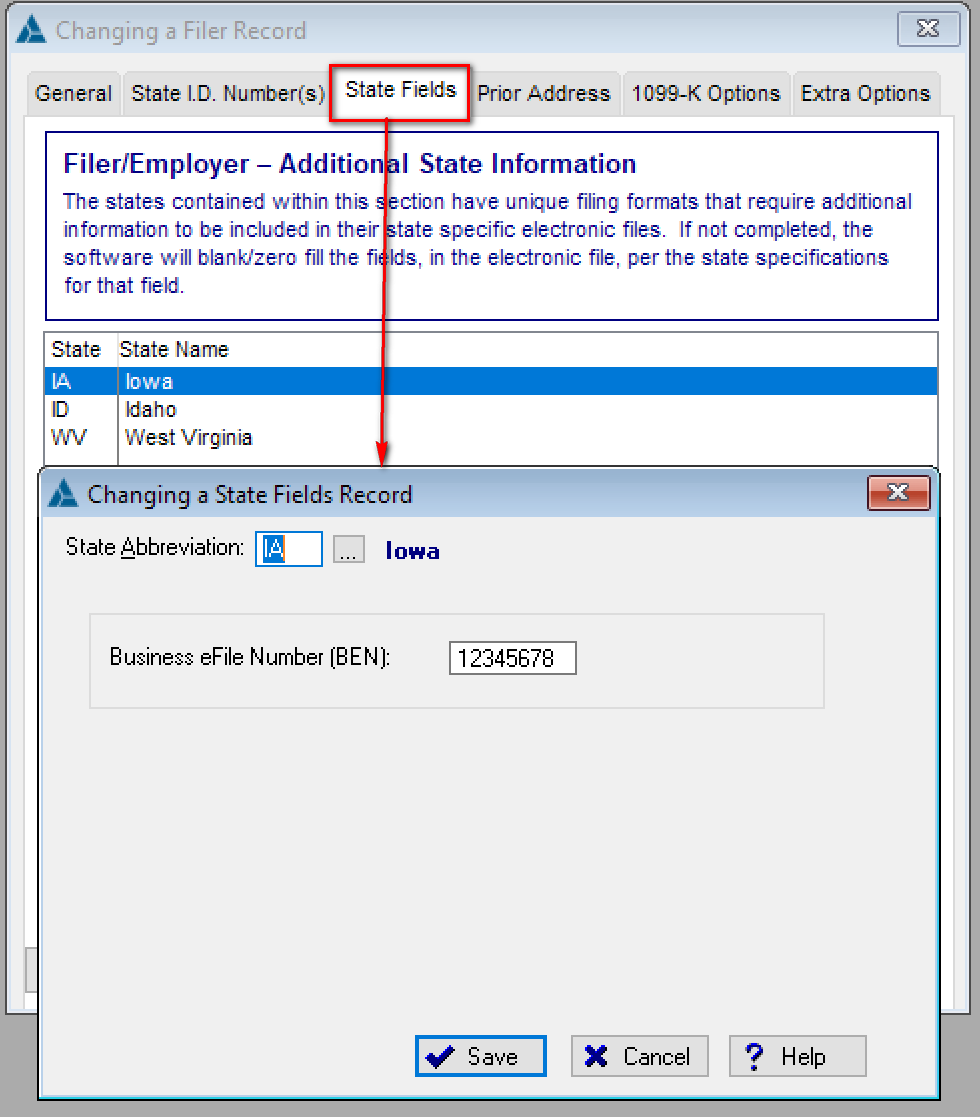

- State Filing - An extra tab was entered to the Filers record called "State Fields". This field captures special information for Iowa (IA), Idaho (ID), and West Virginia (WV) that must be entered in order to accurately file with the states.

- To find this tab, please go to "Manage" filers → Select a Filer → Click on the "State Fields" tab → Click "Add". More information is also in the Help File under the "Special Cases for State Reporting" topic.

- An example of this feature, for Iowa (IA), is below. It depicts how to enter your Business eFile Number (BEN) into the software.

- Reports:

- Custom Fomin Reports - 2020 Forms 3921 & 3922 Fomin Reports (ENTERPRISE-1906).

- eFileViewer:

- Latest eFileViewer included, see - eFileViewer v2020.12.10 Release Notes.

UPDATED:

- All 2020 final tax forms and instructions have been updated with IRS changes.

- Business Rules & Validation:

- 1098-F: Rule R09- Verbiage word changed from "characters" to "code". (ENTERPRISE-1889)

- Reports:

- 1099-PATR - Custom report available fields updated for 2020. (ENTERPRISE-1815)

- Business Rules & Validation:

- Updated default severity, to reject, for 1099-NEC rules (ENTERPRISE-1905)

- R1, R2, R3, R4, R5, R6, R8, & R10

- Updated default severity, to reject, for 1099-NEC rules (ENTERPRISE-1905)

- Import:

- 1099-R - Sample import file with updated header. (ENTERPRISE-1849)

FIXED:

- Printing:

- Form 1096 - 1099-NEC checkbox was not printing.

- Form 1099-R - Alignment print issues for recipient copies. (ENTERPRISE-1823)

- Form 1099-MISC - Alignment print issues. (ENTERPRISE-1844)

- Paper Filing:

- Form 1099-MISC - 1096 filing was calculating 1099-MISC totals incorrectly. (ENTERPRISE-1866)

- General:

- Account Number Generator - Form 1099-NEC were generating account numbers with "??". (ENTERPRISE-1883)

- Account Number Generator - Form 1099-NEC were generating account numbers with "??". (ENTERPRISE-1883)

- Business Rules & Validation:

- Form 5498 -

- Rule R44 was updated to include Box 14b new code BA. (ENTERPRISE-1885)

- Rule R37 updated to include Box 13c new code PL115-97. (PROFESSIONAL-198)

- Reports:

- 1099-R - Amounts/ Totals Report - Total distribution was not totaling. (ENTERPRISE-1858)

- 1099-K - Control Totals Report - Typo fix for "53" to "5c". (ENTERPRISE-1856)

Overview

Content Tools